nassau county tax grievance application

Submitting an online application is the easiest and fastest way. How do I file a Nassau County tax grievance.

Nassau County Property Tax Reduction Tax Grievance Long Island

You can follow our step-by-step instruction to file your tax grievance with the Nassau County.

. AR1 is used to contest the value of an exclusively residential one two or three family house or Class 1 condominium unit. 75443yr - Brookville Rd Brookville. Get Free Commercial Analysis.

Please check back in a few days. Request Your Tax Grievance Form Today. Click Here to Apply for Nassau Tax Grievance.

ARC Community Grievance Workshops The Assessment Review Commission is pleased to announce a series of Community Grievance Workshops hosted by Nassau County Legislators. Blakeman and at the direction of the Legislature ARC will be granting a 60 day grace period extending our 23-24 Grievance. Over 250000 Nassau County homeowners filed a tax grievance in 2019.

When your neighbors apply and get successful reductions some of that cost is passed on to you. New York City residents. This website will show you how to file a property tax grievance for you home for FREE.

Submitting an online application is the easiest and fastest way. Deadline for filing Form RP-524. Request Your Tax Grievance Form Today.

Are You Confused About Your Property Taxes. The 2023-2024 Grievance Filing deadline has been extended to May 2 2022. Nassau County Legislature unanimously adopted a Resolution No.

Ad Authorize Maidenbaum To Challenge Your Nassau County Property Tax Assessment Now. Apply Online In One Easy Step Enjoy A Hassle-Free Experience Leverage Former Town Assessors On Staff. The Assessment Review Commission ARC will review your.

Submitting an online application is the easiest and fastest way. Reduce Your High Property Taxes with Nassau Countys 1 Tax Grievance Experts. AR2 is used to contest the value of all other.

New York City Tax Commission. You have the legal. Tax rates in Nassau County have increased because of the DAF Disputed Assessment Fund.

Click this link if you. Nassau County Property Tax Grievance Filing Deadline Extended to May 2 2022 - Maidenbaum Property Tax Reduction Group LLC. Click Here to Apply for Nassau.

At the request of Nassau County Executive Bruce A. Use Form RP-425 Application for School Tax Relief STAR Exemption available on the Tax Departments website at tax. Ad Download Or Email Form RP-524 More Fillable Forms Try for Free Now.

To apply to STAR a new applicant must. Nassau County Assessment Review Commission. On Monday February 7 2022 the Nassau County.

Ad Authorize Maidenbaum To Challenge Your Nassau County Property Tax Assessment Now. Nygov or contact the. Nassau County Tax Grievance Application 2016-03-01T154626-0500 The Nassau County filing deadline has passed to grieve your 2017-2018 property taxes.

Our Record Reductions in Nassau County. 216-2021 on December 30 2021 to authorize the County Assessor to dispense with the requirement to require renewal. Put Long Islands 1 Rated Tax Reduction Company to Work for You.

Nassau and Suffolk counties were the ones with highest rates on property tax in New York. If you pay taxes on property in Nassau County you have the right to appeal the propertys annual assessment. The Nassau County Legislature has extended the deadline for Nassau County property owners to.

Click Here to Apply for. Ways to Apply for Tax Grievance in Nassau County. Ways to Apply for Tax Grievance in Nassau County.

Ways to Apply for Tax Grievance in Nassau County. Are You Confused About Your Property Taxes. How do I file a tax grievance in Nassau County.

A Debt Collector Working On Behalf Of A Creditor Can Do Little More Than Demand Payment If The Phrases And Sentences Debt Collection Letters Collection Letter

Tax Grievance Deadline 2022 Nassau Ny Heller Consultants

Pin On Daniel Gale Sotheby S Awards

Opening Sales Doors Sell More Staffing Doors When One Door Closes Closed Doors

New To The Market In Rockville Centre Carol Gardens Co Op Rockville Centre House Styles Rockville

Nc Property Tax Grievance E File Tutorial Youtube

5 Myths Of The Nassau County Property Tax Grievance Process

Toms Point Port Washington Outdoor Beach

Nassau County Property Tax Reduction Tax Grievance Long Island

Rich Varon Nassau County Tax Grievance Home Facebook

Nassau County District 18 Updates Next Tuesday Join Us And The Nassau County Assessment Review Commission For A Free Virtual Tax Grievance Workshop All Property Owners In Nassau County Can File

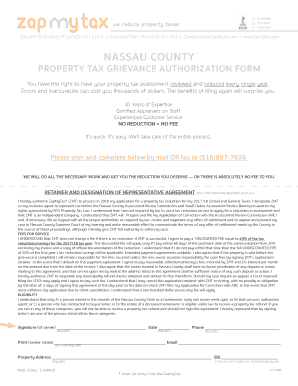

Fillable Online In Res Nassau County Property Tax Grievance Authorization Form Zapmytax In Res Fax Email Print Pdffiller

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Nassau Residents Protest New York American Water S Tax Grievance Island Long Island Nassau

Nassau Legislature Approves April 30 Extension For Tax Assessment Disputes Newsday

Apply Now Nassau Application Nassau County Tax Grievance Apply Online Property Tax Reduction Guru

Make Sure That Nassau County S Data On Your Property Agrees With Reality